India’s Trade Choices – China vs USA

{{#GS3# Economy#IndiaChina# IndiaUs}}

Why in News?

PM Narendra Modi is set to visit Tianjin for the 2025 SCO Summit and will meet Chinese President Xi Jinping to discuss closer economic ties.

- This comes at a time when US tariffs on Indian goods have sharply increased, straining India-US trade relations.

What is the Issue?

India is caught between two major powers — China (world’s largest manufacturer) and the US (world’s largest consumer market).

- While the US is raising tariffs on Indian exports, India’s trade with China is already highly imbalanced.

- Policymakers face the dilemma: Closer trade with China or the US?

The News - The US, under Trump’s tariff-first approach, has imposed up to 50% tariffs on Indian goods.

- China is reaching out diplomatically to India, urging closer cooperation and opposing US tariffs.

- However, experts caution that deepening trade with China poses greater long-term risks for India compared to dealing with the US.

Analysis India’s Deepening Trade Weakness with China:

- Trade Imbalance: India has a $40 billion trade surplus with the US (exports exceed imports), but a nearly $100 billion trade deficit with China, with imports surging since 2014 despite anti-China rhetoric post-Galwan.

- Import Dependence: Charts show India’s growing reliance on Chinese intermediates (e.g., electronics, machinery), undermining self-reliance goals like Atmanirbhar Bharat.

- Impact of Liberalization: Increased trade with China risks widening this deficit, flooding Indian markets with low-cost goods, and stifling domestic industries, unlike the US where India holds a competitive edge.

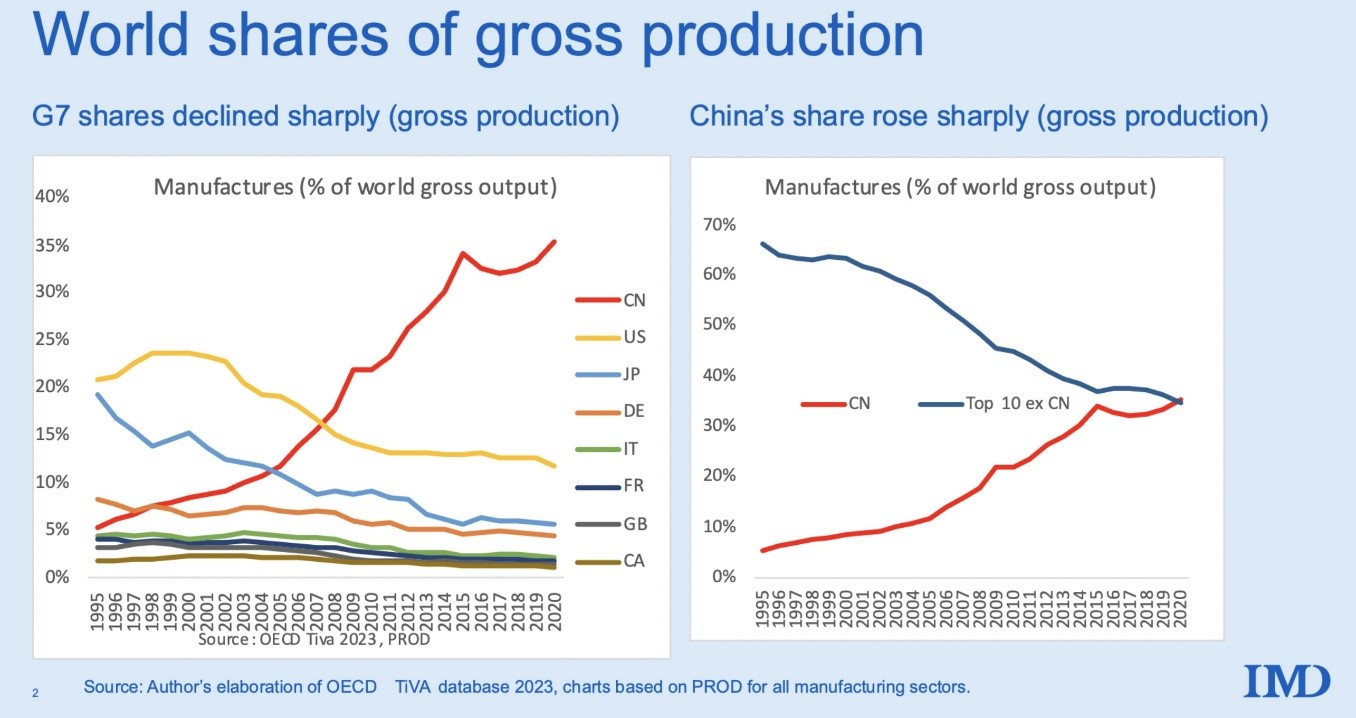

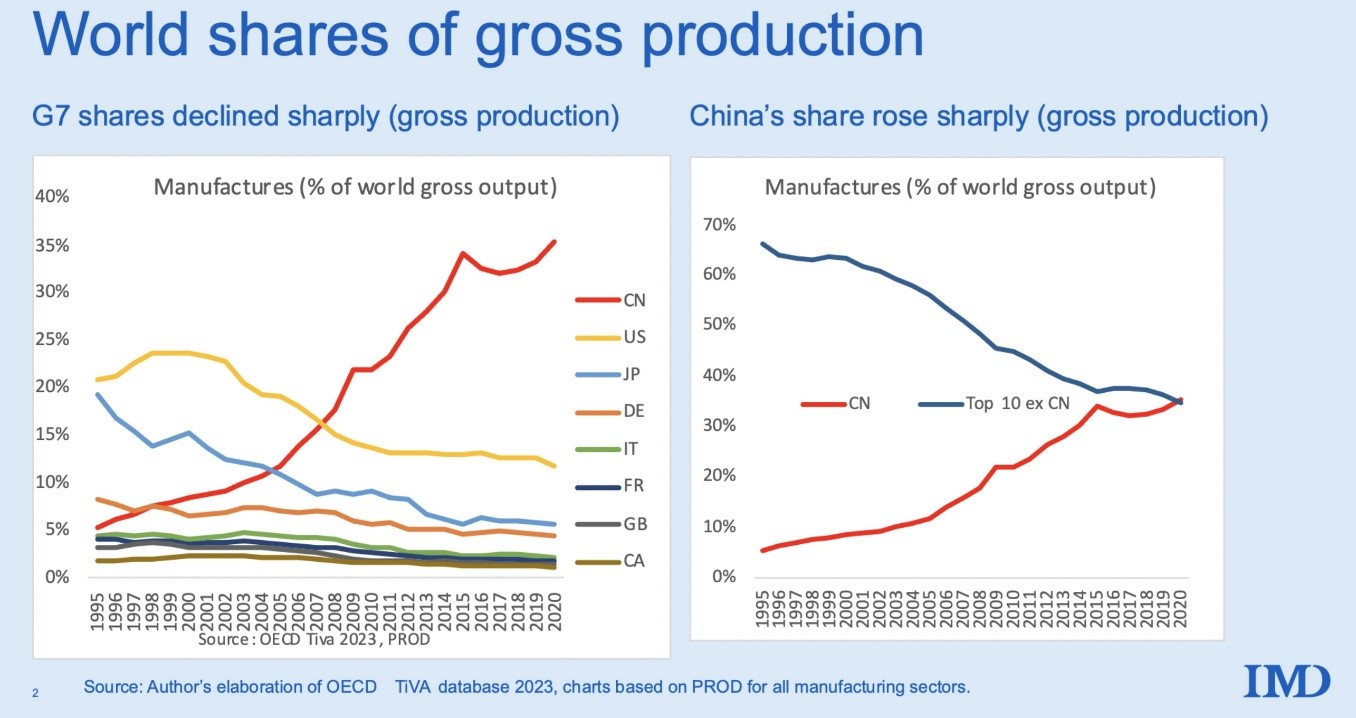

China’s Tremendous Strength in Manufacturing:

- Global Dominance: Economist Richard Baldwin calls China the “world’s sole manufacturing superpower,” akin to the US’s military dominance. Charts show China’s 35% share of global manufacturing output (2020), surpassing the next 10 countries combined.

- Export Prowess: China’s share of global merchandise exports has spiked over 25 years, driven by state-led industrialization, scale, and supply chain efficiencies, enabling cheap, competitive exports.

- Threat to India: Trade liberalization with China risks decimating Indian sectors like textiles and electronics, as feared during RCEP talks, where cheap imports could “swamp” markets.

India’s Growing Weakness in Manufacturing: - Stagnant Growth: India’s manufacturing GVA grew at a 4% CAGR since 2019-20, trailing agriculture’s 4.7%, highlighting the “Faltering Make in India” initiative.

- Relative Disadvantage: In a “zero-sum” trade game, India’s lagging manufacturing cannot compete with China’s overcapacity, making it vulnerable to import surges.

- Lost Opportunities: Post-Covid, India’s “China +1” pitch to Western firms (competing with Vietnam, Mexico) has seen limited success due to infrastructure, skill, and policy gaps, weakening its global positioning.

Impact on India’s “China +1” Claim: - Western Investor Concerns: As US allies like Mexico raise tariffs on Chinese goods (e.g., textiles, autos, per August 28 Bloomberg report), aligning with China could signal to Western businesses that India is not a true de-risking alternative.

- US Pressure Risks: Anecdotal evidence suggests US influence on allies’ tariffs. If India aligns with China, it may face secondary US sanctions or exclusion from US-led supply chains, jeopardizing its $5 trillion economy goal.

- Strategic Dilemma: Balancing China ties with Western investment appeal is critical, as India’s “China +1” pitch hinges on being a reliable, independent hub.

Dealing with China’s Rising Overcapacity: - Deflation Crisis: China faces deflation from overproduction, where falling prices deter consumption and production, risking economic stagnation.

- Export Push: With US and allied markets (e.g., Mexico) imposing barriers, China seeks to offload excess capacity (e.g., steel, solar panels, EVs) to countries like India.

- Risk for India: Closer ties could force India to absorb cheap Chinese goods, eroding domestic competitiveness, increasing deficits, and causing job losses in vulnerable sectors.

China Not a Natural Partner for India:

- Governance Mismatch: India pursues a private sector-led, democratic market economy with transparent rules and free media, while China’s authoritarian model blurs state-private lines, complicating trust.

- Geopolitical Tensions: China’s support for Pakistan, India’s adversary, includes military supplies (e.g., equipment used in the April Pahalgam attack). Persistent border disputes post-Galwan further strain relations.

- Strategic Misalignment: China’s dominance in SCO and BRI often prioritizes its interests, making stable, equitable economic collaboration with India challenging.

Challenges & Limitations with China 1. Rising Trade Deficit – Import dependence growing despite political tensions. 2. Manufacturing Prowess of China – China is the world’s manufacturing superpower (35% of global output vs India’s 3%).

3. Weak Indian Manufacturing – India’s manufacturing growth is sluggish; “Make in India” hasn’t delivered expected results.

4. China +1 Strategy – Western firms seek alternatives to China; if India leans too close to Beijing, it risks losing foreign investment opportunities. 5. Overcapacity in China – Cheaper Chinese goods could flood Indian markets, hurting domestic producers.

6. Geopolitical Distrust – Border tensions (e.g., Galwan, 2020) and China’s support to Pakistan reduce trust.

Future Prospects for India

- Diversify Trade Partners – Strengthen ties with EU, ASEAN, Japan to reduce dependence on both US & China.

- Boost Manufacturing – Real reforms in labour, land, logistics, and infrastructure are critical.

- Leverage India’s Strengths – Services exports, digital economy, pharmaceuticals, and green tech can balance deficits.

- Strategic Autonomy – India must avoid overdependence on either China or US, keeping its trade and strategic options open.

Prelims Practice Question Q. Consider the following statements about India’s trade relations: 1. India has a trade surplus with the United States.

2. India’s largest trade deficit is with China.

3. China accounts for over one-third of global manufacturing output. Which of the above statements is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Answer: (d) 1, 2 and 3