Syllabus: GS 3: Indian Economy – Government budgeting, fiscal policy, public expenditure and debt management

The article critically examines the Union Budget 2026–27 with a focus on fiscal consolidation, analysing whether the current expenditure priorities, revenue assumptions, and deficit targets are sustainable while pursuing the long-term goal of making India a developed country by 2047.

1. Budget priorities and the development narrative

The author acknowledges that the Budget speech places strong emphasis on advanced technology sectors such as Artificial Intelligence, semiconductors, biopharma, and critical minerals.

However, the concern raised is not about intent, but about implementation capacity and pace, which will ultimately determine whether the Viksit Bharat vision can be realised.

2. Shift in expenditure structure

Over the last decade, there has been a clear restructuring of government expenditure:

Revenue expenditure as a share of total expenditure declined from 88% (2014–15) to about 77% (2026–27 BE).

Central subsidies fell significantly, while capital expenditure increased.

This shift has supported GDP growth, especially in the post-COVID period, where public capex played a counter-cyclical role.

3. Slowing momentum of capital expenditure

Although capital expenditure remains high as a percentage of GDP, the growth rate of capex has slowed:

From 28.3% (2023–24) to 10.8% (2024–25) and 4.2% (2025–26 RE).

For 2026–27, capex growth is budgeted at 11.5%, only marginally above the assumed nominal GDP growth. This implies that capex will stagnate around 3.1% of GDP, raising concerns about its future growth impulse.

4. Revenue buoyancy and tax structure concerns

Gross tax revenue buoyancy for 2026–27 is projected at 0.8, well below the benchmark of 1.

Direct taxes show relatively better buoyancy, while indirect taxes, especially GST, lag behind GDP growth.

The article argues that without restructuring indirect taxes, fiscal consolidation may face structural limits.

5. Centre–State fiscal relations

States’ share in divisible pool at 41%.

No revenue deficit grants.

While this maintains fiscal discipline, the author notes that it results in reduced overall transfers to States compared to earlier Finance Commission periods, potentially constraining State-level spending.

6. Pace of fiscal consolidation

Post-COVID, annual reduction averaged 0.7 percentage points.

This slowed to 0.4 points in 2025–26 (RE) and 0.1 point in 2026–27 (BE).

The shift from targeting fiscal deficit to debt-GDP ratio does not automatically guarantee credibility, since both are closely linked to nominal GDP growth assumptions.

7. Debt sustainability and interest burden

India’s high debt-GDP ratio has serious implications:

Effective interest rate on central government debt is estimated at 7.12% in 2026–27.

Interest payments consume nearly 40% of revenue receipts, severely squeezing fiscal space for primary expenditure.

This creates a risk of crowding out development spending.

Adopt a transparent fiscal glide path, clearly linking debt and deficit targets to realistic nominal GDP growth assumptions.

Reaffirm commitment to FRBM targets of 40% debt-GDP ratio and 3% fiscal deficit.

Improve indirect tax buoyancy, especially GST, to strengthen revenue sustainability.

Maintain fiscal deficit at 3% of GDP to prevent excessive government borrowing that crowds out private investment.

“Fiscal consolidation is not merely about reducing deficits but about ensuring long-term debt sustainability.” In the context of the Union Budget 2026–27, critically examine India’s fiscal consolidation strategy.

The U.S. trade deal — gains from economic diplomacySyllabus: GS 2: International Relations – India–U.S. relations, economic diplomacy

GS 3: Indian Economy – External sector, trade, exports and industrial growth

Context

The article analyses the India–U.S. trade deal, highlighting how sustained economic diplomacy, patient negotiations and tariff rationalisation have strengthened India’s export competitiveness, deepened strategic trust, and repositioned the bilateral relationship beyond transactional trade.

Detailed Analysis

1. Economic diplomacy at scale

The author argues that India’s trade strategy is now operating systematically and at scale, resembling a well-planned economic architecture.

The India–U.S. deal is presented as the outcome of years of sustained dialogue, technical negotiations and quiet diplomacy, rather than a short-term political bargain.

2. Tariff reduction as a breakthrough

A key achievement of the deal is the reduction of U.S. tariffs on Indian goods from 18% to 0%.

This move:

Restores price competitiveness of Indian exports.

Provides policy certainty to exporters.

Removes a structural disadvantage faced by Indian firms in the U.S. market.

The author notes that tariff moderation has an outsized impact in sectors where margins are thin.

3. Export gains in employment-intensive sectors

The article highlights clear sectoral benefits, particularly for:

Apparel and textiles – where India now competes better with Vietnam and Bangladesh.

Gems and jewellery – highly sensitive to tariff changes.

Footwear, leather, marine products and processed foods – where even small tariff cuts significantly improve landed costs.

These sectors are labour-intensive, meaning the gains translate directly into employment creation.

4. Strengthening India’s position in global value chains

Lower tariffs improve India’s ability to:

Integrate into diversified global supply chains.

Encourage firms to expand capacity.

Move closer to India’s long-term goal of becoming a global manufacturing hub.

The deal also improves India’s competitive position vis-à-vis China, ASEAN countries, Brazil, Sri Lanka and Pakistan.

5. Beyond tariffs: opening space for deeper cooperation

The author stresses that the agreement is not limited to immediate trade relief. It creates space to address:

Regulatory cooperation

Market access issues

Supply chain resilience

These discussions will be carried forward under the India–U.S. Bilateral Trade Agreement (BTA) framework.

6. Strategic implications of the trade deal

From a geopolitical lens, the deal:

Reinforces India–U.S. cooperation in forums like the Quad.

Aligns with shared priorities such as trusted supply chains and economic security.

Demonstrates how trade can complement defence, technology and energy partnerships.

The author views the deal as a trust-building exercise, marking a reset in bilateral economic ties.

7. Role of industry going forward

The article underlines that policy alone is insufficient.

Indian industry must:

Invest in scale, technology and productivity.

Leverage improved market access to move up the value chain.

Strengthen competitiveness to sustain gains from tariff liberalisation.

Author’s Suggestions

Use tariff relief as a launchpad for long-term reforms, not a temporary advantage.

Deepen engagement under the Bilateral Trade Agreement to resolve structural trade issues.

Encourage industry-led investment and innovation to fully exploit new opportunities.

Treat trade diplomacy as part of a broader strategic partnership, not an isolated economic tool.

UPSC Mains Practice Question

“Trade agreements today are as much instruments of strategic trust as of economic gain.” Examine this statement in the context of the recent India–U.S. trade deal.

Source: The Hindu

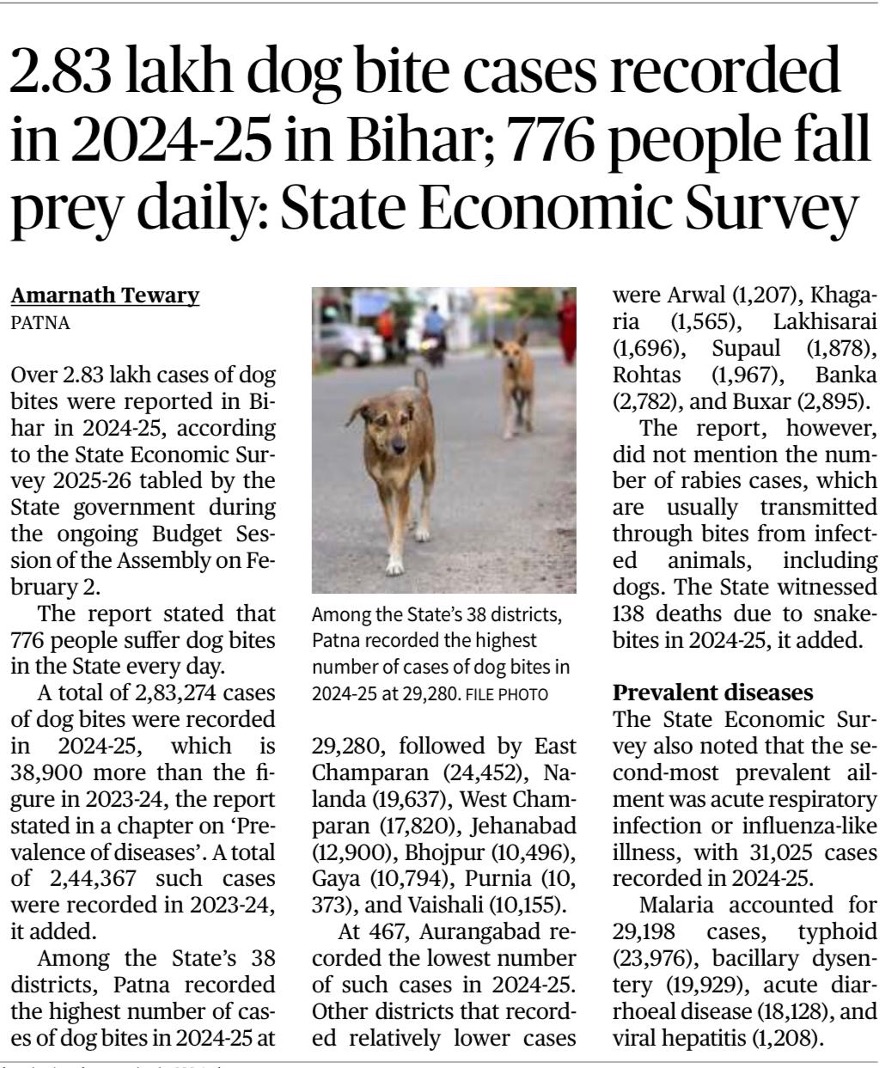

2.83 lakh dog bite cases recorded in 2024-25 in Bihar; 776 people fall prey daily: State Economic Survey

Syllabus: GS 2: Governance – Health, public health systems

GS 3: Indian Economy – Human development indicators, social sector

Context

The issue is in news as the State Economic Survey 2025–26 tabled during the Budget Session revealed a sharp rise in dog bite cases in Bihar during 2024–25, highlighting public health and urban governance concerns.

Key Points

Scale of the Problem

2,83,274 dog bite cases recorded in 2024–25.

This is an increase of 38,900 cases compared to 2023–24.

On average, 776 people suffer dog bites daily.

District-wise Distribution

Patna reported the highest number of cases at 29,280.

Other high-incidence districts include East Champaran, Nalanda, West Champaran, Jehanabad and Bhojpur.

Aurangabad recorded the lowest number of cases at 467.

Public Health Concerns

The report did not specify rabies cases, though dog bites are a major transmission route.

Highlights gaps in disease surveillance and reporting related to zoonotic diseases.

Related Mortality Data

The State recorded 138 deaths due to snake bites in 2024–25.

Reflects broader challenges in animal–human conflict management and emergency healthcare access.

Disease Burden in the State

Second most prevalent ailment: acute respiratory infection / influenza-like illness.

Other major diseases reported: malaria, typhoid, bacillary dysentery, acute diarrhoeal disease and viral hepatitis.

State Economic Survey 2025–26

The data was presented by the Bihar government during the Budget Session.

The survey provides district-wise health indicators under the chapter on prevalence of diseases.

UPSC Prelims Practice Question

Consider the following statements:

1.The State Economic Survey 2025–26 reported an increase in dog bite cases in Bihar compared to the previous year.

2.Patna recorded the lowest number of dog bite cases among Bihar’s districts in 2024–25.

3.Dog bites are a potential source of transmission of rabies.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Correct Answer: (a) 1 and 3 only

Explanation:

Statement 1 is correct as dog bite cases increased by about 38,900 from 2023–24.

Statement 2 is incorrect because Patna recorded the highest number of cases, not the lowest.

Statement 3 is correct since rabies is commonly transmitted through bites of infected animals, including dogs.

Source: The Hindu

Denotified tribes seek constitutional recognition, separate Census entry

Syllabus: GS 2: Polity and Governance – Vulnerable sections, constitutional recognition, Census

GS 1: Indian Society – Marginalised communities

Context

Denotified, nomadic and semi-nomadic tribes are demanding a separate column in Census 2027 and constitutional recognition, arguing that decades of misclassification have kept them invisible in policy and welfare delivery.

Key Points

Who are Denotified Tribes (DNTs)

Communities earlier notified as “criminal tribes” under the Criminal Tribes Act, 1871.

The Act was repealed in 1952, after which these groups were termed denotified tribes.

Include nomadic and semi-nomadic tribes with mobile livelihoods.

Issue of Misclassification

Many DNTs have been absorbed into SC, ST or OBC lists over decades.

Leaders argue this hides graded backwardness within these groups.

About 267 communities remain outside SC, ST and OBC classifications.

Demand for Separate Census Entry

Demand for a separate column/code in Census 2027.

Aim is to ensure accurate enumeration and avoid being statistically invisible.

Census data is seen as crucial for targeted policy design and budgeting.

Demand for Constitutional Recognition

Seeking inclusion in a separate Constitutional Schedule, similar to SCs and STs.

Argument is that existing categories do not reflect their distinct historical injustice.

Demand includes sub-classification to reflect internal diversity and deprivation.

Historical Injustice

The 1871 law enabled registration, surveillance and control of entire communities.

Many DNTs were among the earliest groups to resist British rule.

Stigma from colonial classification continues to affect access to rights and services.

Findings of Expert Bodies

The Idate Commission (2017) identified around 1,200 DNT communities.

Most were gradually merged into SC, ST or OBC lists over seven decades.

The commission flagged continued social exclusion and administrative neglect.

Administrative Challenges

Very low issuance of DNT caste certificates by States.

Poor utilisation of schemes like SEED, despite allocated funds.

Lack of official identity limits access to education, housing and livelihoods.

Legal and Policy Context

Reference made to a Supreme Court judgment (August 2024) that enabled sub-classification within SCs and STs.

Leaders cite this as a precedent for recognising graded backwardness.

Office of the Registrar General of India

Has assured inclusion of denotified, nomadic and semi-nomadic tribes in the next caste enumeration.

Communities seek clarity on separate coding and classification.

UPSC Prelims Practice Question

Consider the following statements regarding Denotified Tribes (DNTs):

1.Denotified tribes were earlier classified as criminal tribes under a colonial law repealed in 1952.

2.All denotified tribes in India are currently included within the SC, ST or OBC categories.

3.A separate Census enumeration is demanded to ensure accurate data for policy formulation.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Correct Answer: (a) 1 and 3 only

Explanation:

Statement 1 is correct as DNTs were decriminalised after repeal of the Criminal Tribes Act in 1952.

Statement 2 is incorrect because around 267 DNT communities remain outside SC, ST and OBC lists.

Statement 3 is correct since a separate Census entry is demanded for visibility and targeted welfare.

Source: The Hindu

Indian cities could see far higher temperature rise than projected, says study

Syllabus:: GS 3: Environment – Climate change, urbanisation, disaster vulnerability

Context

The news is based on a recent scientific study which warns that Indian cities may heat up much faster than projected by global climate models, mainly due to the urban heat-island effect, increasing climate risks for urban populations.

Key Points

Core Finding of the Study

Climate models may be underestimating urban temperature rise by 0.5°C to 2°C.

Non-metropolitan Indian cities could heat up much faster than surrounding rural areas.

Cities Warming Faster than Rural Areas

Study analysed 104 medium-sized cities in tropical and sub-tropical regions.

Focus was on how much faster cities warm compared to nearby countryside, not just average warming.

Evidence from Indian Cities

18 Indian cities were included in the study.

All cities showed faster warming than surrounding rural regions.

On average, Indian cities experience about 45% more warming than projected by Earth System Models.

Urban Heat-Island Effect

Urban heat-island effect refers to cities being hotter than nearby rural areas.

Caused by concrete surfaces, reduced vegetation, dense construction and waste heat.

This effect amplifies temperature rise beyond global climate projections.

Illustrative Example

In Patiala, Punjab, climate models predict a 2°C rise.

When urban heat-island effects are included, the actual rise could be around 4°C.

Land surface temperatures may rise at double the projected rate.

Implications for Human and Economic Systems

Higher vulnerability to heat strokes and heat-related illnesses.

Increased stress on water availability.

Rising public expenditure on cooling and healthcare.

Greater energy demand, affecting urban infrastructure and power grids.

UPSC Prelims Practice Question

Consider the following statements regarding the urban heat-island effect:

1.It causes urban areas to record higher temperatures than nearby rural areas.

2.It is mainly due to higher greenhouse gas concentrations in cities.

3.It can lead to underestimation of actual temperature rise in cities by global climate models.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Correct Answer: (a) 1 and 3 only

Explanation:

Statement 1 is correct as urban heat islands make cities hotter than surrounding rural areas.

Statement 2 is incorrect because the effect is primarily due to land use changes, built surfaces and lack of vegetation, not greenhouse gas concentration alone.

Statement 3 is correct as the study shows climate models may underestimate city-level warming.

Source: The Hindu

Mist sprays installed across all elevated metro stations: CM

Syllabus: GS 2: Governance – Urban governance, environmental management

GS 3: Environment – Air pollution and mitigation measures

Context

The news is in focus as the Delhi government announced the installation of mist spray systems and anti-smog guns across all elevated metro stations to curb rising air pollution in the city.

Key Points

Government Initiative

Mist spray systems installed at all 143 elevated metro stations in Delhi.

Aim is to reduce particulate matter and improve local air quality.

Air pollution control identified as a top governance priority.

Implementation Details

131 mist spray systems installed where technically feasible.

12 anti-smog guns deployed at stations where mist sprays could not be installed.

Ensures no gaps in pollution-control coverage due to infrastructure constraints.

Urban Pollution Mitigation

Mist sprays help suppress dust and fine particulates in high-traffic areas.

Anti-smog guns are used as localized pollution control tools.

Focus on ground-level, practical interventions rather than only policy measures.

Broader Urban Vision

Measures go beyond short-term pollution relief.

Part of a plan to develop Delhi into a clean, vibrant and world-class city.

Integrates public transport infrastructure with environmental action.

Government of Delhi

The initiative was announced by the Chief Minister of Delhi.

Reflects the State’s emphasis on urban environmental governance and public health protection.

Source: The Hindu

Manipur President’s Rule ends; Khemchand new CM

Syllabus: GS 2: Polity and Governance – State government, President’s Rule, Centre–State relations

Context

The news is in focus as President’s Rule in Manipur has been revoked and a new Council of Ministers has been sworn in, ending nearly a year of central rule imposed due to ethnic violence and political instability.

Key Points

End of President’s Rule

President’s Rule was imposed on February 13, 2025.

It followed the resignation of former Chief Minister N. Biren Singh.

The proclamation marked nearly one year of central governance in the State.

Appointment of New Chief Minister

Yumnam Khemchand Singh sworn in as the Chief Minister of Manipur.

He represents the Singjamei Assembly constituency.

Other Ministerial Appointments

Two more MLAs were sworn in as Cabinet Ministers.

Ministers include representatives from Meitei, Kuki-Zo and Naga communities.

Background of the Crisis

Ethnic violence between Meitei and Kuki-Zo communities began on May 3, 2023.

The prolonged unrest disrupted governance and led to central intervention.

Priorities of the New Government

New CM stated that peace restoration is the top priority.

Focus on development, stability and rebuilding trust among communities.

Emphasis on cooperative functioning with the Centre.

UPSC Prelims Practice Question

Consider the following statements regarding President’s Rule in a State:

1.President’s Rule is imposed under Article 356 of the Constitution.

2.During President’s Rule, the State Legislative Assembly is automatically dissolved.

3.The executive authority of the State is exercised by the President through the Governor.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Correct Answer: (a) 1 and 3 only

Explanation:

Statement 1 is correct as President’s Rule is imposed under Article 356.

Statement 2 is incorrect because the Assembly may be kept under suspended animation and need not be dissolved immediately.

Statement 3 is correct since the Governor administers the State on behalf of the President.

Source: The Hindu