There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

| Index | ||

| S.No | Topic | |

| Daily Hindu Analysis (YouTube) | ||

| 1. | Will ISRO’s arm NSIL pick up the slack of a flat space budget? | |

| 2. | What’s ailing India’s battery scheme for EVs? | |

| 3. | Rare earth corridors to cut China imports | |

| 4. | Labour-intensive textile sector, MSMEs to get new schemes | |

| 5. | Banking sector set for sea change; PFC, REC to be restructured | |

| 6. | Capex scale-up | |

| 7. | IIT-Kanpur team develops new way to predict solar cycles | |

| 8. | El Nino might occur after July; a clear picture will emerge after April: IMD | |

| 9. | Thousands rally over Manipur’s territorial integrity | |

The article analyses why India’s Advanced Chemistry Cell (ACC) Production Linked Incentive (PLI) scheme, launched to build a domestic battery manufacturing ecosystem for electric vehicles (EVs), has fallen short of targets, and how these gaps could affect India’s EV transition and energy security.

Detailed Analysis

1. Ambition versus outcomes

The ACC PLI scheme aimed to create 18,100 GWh of battery manufacturing capacity.However, by October 2025, only 1.4 GWh had been operationalised.Even in terms of investment, just about 55% of the targeted ₹18,100 crore has materialised.Author’s concern: The scale of underperformance is large enough to undermine the domestic EV supply chain.

2. Technology-heavy design of the ACC schemeThe scheme focuses on advanced chemistry cells, not conventional lithium-ion batteries.Technologies promoted include lithium-ion, lithium iron phosphate (LFP), and sodium-ion chemistries.While forward-looking, this approach raises entry barriers due to high capital and R&D requirements.

3. Missing ecosystem: refining and component manufacturingBattery manufacturing depends heavily on upstream activities such as mineral refining and cathode/anode production.India lacks sufficient domestic capability in critical minerals processing, increasing dependence on imports.Without parallel incentives for the full value chain, gigafactories remain unviable.

4. Delayed implementation and weak disbursementThough the scheme was launched in October 2021, capacity commissioning has been slow.No incentive disbursement occurred until 2024, reducing investor confidence.In FY25, only ₹200 crore was disbursed, as production milestones were not met.

5. Design flaws in incentive structureIncentives are tied to actual battery production, not capacity creation.Firms must commit to minimum output levels (e.g., 5 GWh over five years).This discourages new entrants and favours established players with deeper capital.

6. Limited beneficiary poolIn the first round, only three firms were selected.In the second round, capacity allocation remained concentrated among a few players.This has reduced competition and slowed innovation.

7. China dependency and supply chain risksIndia continues to rely heavily on China for battery components and raw materials.Global supply chain disruptions and geopolitical risks further delay project execution.Approval delays for sourcing technology from foreign partners add to uncertainty.

Suggestions Highlighted by the AuthorFast-track implementation timelines by at least one year to restore investor confidence.Introduce separate incentives for mineral refining and component manufacturing.Reduce minimum output thresholds to encourage more players.Improve coordination between EV demand-side incentives and battery supply-side policies.Shift from a narrow production focus to ecosystem-based support.

UPSC Mains Practice Question

The ACC PLI scheme reflects strong policy intent but weak execution. Critically assess this statement in the context of India’s EV battery manufacturing ecosystem.

Context:

In the Union Budget 2026, the government announced support for creating rare earth corridors in mineral-rich States to reduce India’s heavy dependence on China for rare earth imports and strengthen domestic processing and manufacturing capacity.

Key Points

What are rare earth corridors

Integrated zones to promote mining, processing, research, and manufacturing of rare earth elements (REEs).Proposed in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu.

Why the move is significant

India is the second-largest importer of Chinese rare earths after Japan.Over 45% of India’s rare earth imports come from China.China’s dominance in rare earthsChina contributes over 60% of global rare earth production.Controls nearly 92% of global refining capacity, giving it leverage in global supply chains.Dominance is due more to long-standing mining, refining, and R&D strength than mere resource availability. Import trendIndia’s rare earth imports increased from $14.1 million (2014) to $17.5 million (2024).Dependence has risen despite domestic mineral availability.

Strategic and geopolitical angle

China is using rare earths as a bargaining chip in trade tensions, especially with the U.S.Rare earths are critical for EVs, wind turbines, defence systems, and electronics. Nature of rare earth elementsREEs consist of 17 metals, classified into light and heavy rare earths.They are not geologically scarce, but economically viable extraction and processing are complex.

Challenges for India

Limited domestic refining and separation capacity.Weak downstream ecosystem in high-end manufacturing.Environmental and regulatory hurdles in mining. International Energy Agency (IEA)’s View:According to the International Energy Agency, China dominates global refining and processing of rare earths.Rare earths are essential inputs for clean energy technologies and strategic industries. UPSC Prelims Practice QuestionConsider the following statements regarding rare earth elements:

1.China’s dominance in rare earths is primarily due to its control over global refining and processing capacity.2.Rare earth elements are geologically scarce and found only in a few countries.Which of the statements given above is/are correct?

a) 1 only

b) 2 onlyCorrect Answer: a) 1 onlyExplanation:

Statement 1 is correct as China controls most of the refining and processing, not just mining.

Statement 2 is incorrect because rare earths are widely distributed, but processing them is technologically and environmentally challenging. Source: The Hindu

b) 2 only

c) Both 1 and 2

d) Neither 1 nor 2

Correct Answer: c) Both 1 and 2Explanation:

Statement 1 is correct as the Budget mandates TReDS for CPSE–MSME transactions.

Statement 2 is correct because Samarth 2.0 focuses on textile skill development. Source: The Hindu

GS 3: Economy – Banking sector reforms, financial institutions, NBFCs, infrastructure financing

Context :In the Union Budget 2026, the government proposed major structural reforms in the banking sector, including setting up a High Level Committee on Banking for Viksit Bharat and restructuring PFC and REC to improve efficiency and align them with future financing needs

. Key PointsHigh Level Committee on Banking

Government to constitute a High Level Committee on Banking for Viksit Bharat.Objective is to review the financial sector comprehensively and align it with India’s next phase of growth.Focus on financial stability, inclusion, consumer protection, and efficiency. Current strength of the banking sector

Public sector banks show strong balance sheets and historic highs in profitability.Asset quality has improved significantly with NPAs at multi-year lows.Banking coverage exceeds 98% of villages, reflecting deep financial inclusion.

Debate on public vs private banking

Some experts view reforms as a signal towards greater private sector role.Trade unions argue public sector banks play a stabilising role, especially in rural credit and priority-sector lending.

Role of public sector banks

Expansion of rural branches and financial inclusion largely enabled by nationalised banks.Continued importance in priority sector lending and social objectives. Restructuring of PFC and RECBudget proposes restructuring Power Finance Corporation (PFC) and Rural Electrification Corporation (REC).Aim is to achieve greater scale, operational efficiency, and alignment with public sector NBFC reforms. Future-oriented financingRestructured entities to support renewable energy, nuclear power, transmission, and energy storage.Ensures availability of long-term capital for energy transition and infrastructure expansion. NBFC reform angleMove helps large public sector NBFCs align with current regulatory and market requirements.Expected to improve risk management and capital mobilisation. Power Finance Corporation (PFC) and Rural Electrification Corporation (REC)Power Finance Corporation and Rural Electrification Corporation are key public sector NBFCs financing India’s power sector.Their restructuring is intended to strengthen funding for energy security and clean energy goals.

UPSC Prelims Practice Question

Consider the following statements:

1.The Union Budget 2026 proposed the setting up of a High Level Committee on Banking for Viksit Bharat.2.Power Finance Corporation and Rural Electrification Corporation are scheduled commercial banks regulated under the Banking Regulation Act.Which of the statements given above is/are correct?a) 1 only

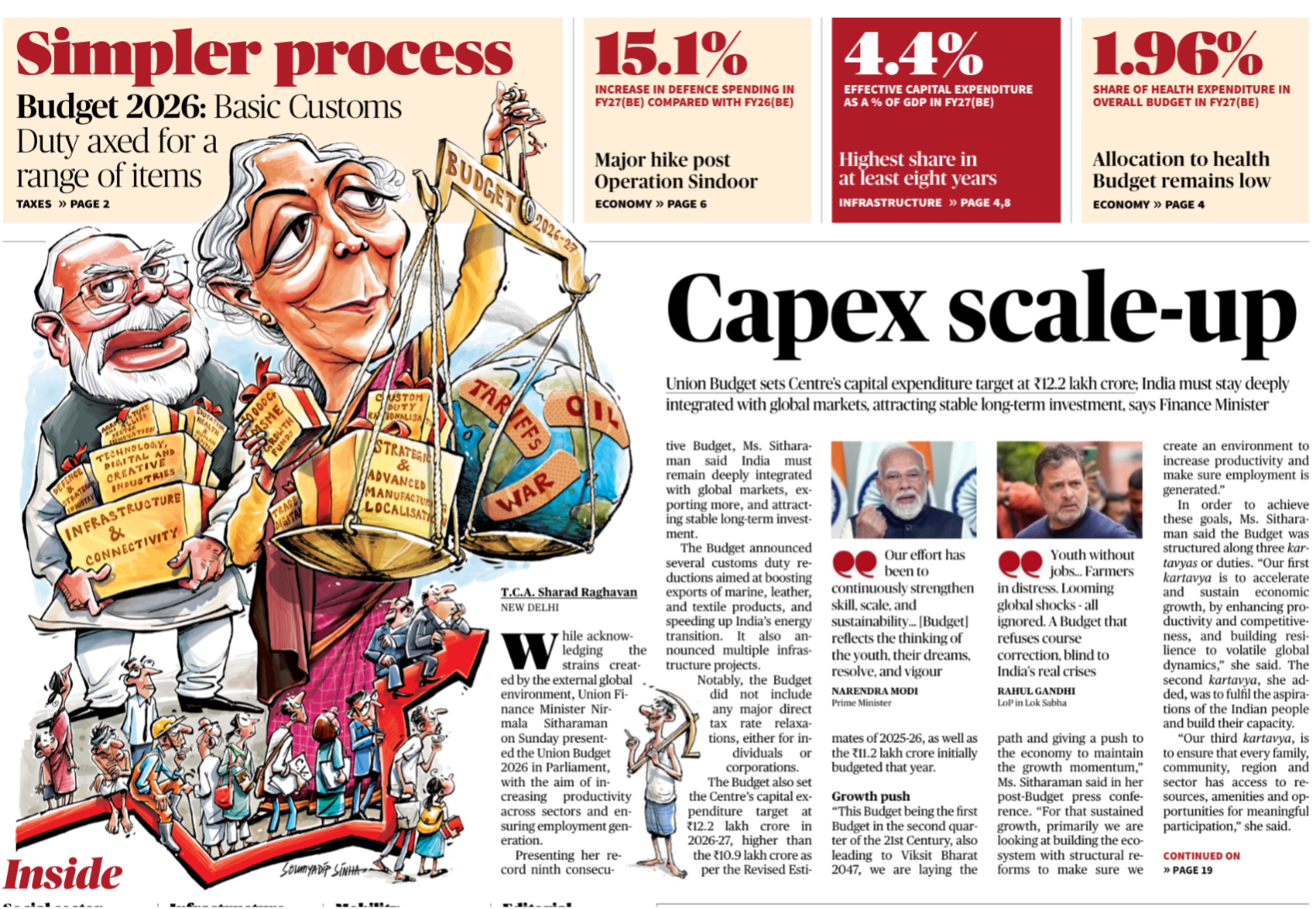

b) 2 onlyGS 3: Economy – Public finance, capital expenditure, infrastructure-led growth

Context:

The Union Budget 2026–27 has announced a significant scale-up in capital expenditure (capex) to sustain economic growth, strengthen infrastructure, and crowd in private investment amid global economic uncertainties. Key PointsCapex target in Budget 2026Centre’s capital expenditure set at ₹12.2 lakh crore for 2026–27.Higher than the ₹10.9 lakh crore in Revised Estimates of 2025–26. Share in GDPEffective capital expenditure at 4.4% of GDP, the highest level in at least eight years.Signals continued focus on infrastructure-led growth. Rationale behind capex pushGovernment views capex as a growth multiplier, boosting productivity and job creation.Intended to crowd in private investment by improving logistics and connectivity. No major tax concessionsBudget does not include significant direct tax reliefs for individuals or corporates.Growth strategy relies more on public investment than consumption stimulus. Customs duty rationalisationBasic Customs Duty removed or reduced on several items.Aims to simplify the tax structure and support manufacturing, exports, and energy transition. Sectoral focusEmphasis on infrastructure, advanced manufacturing, energy transition, and logistics.Supports India’s integration with global value chains. Medium-term visionBudget aligned with the goal of Viksit Bharat 2047.Focus on sustaining growth, improving competitiveness, and building resilience to global shocks.

UPSC Prelims Practice Question

Consider the following statements:1.The Union Budget 2026–27 set the Centre’s capital expenditure target at ₹12.2 lakh crore.2.Effective capital expenditure in Budget 2026–27 is the lowest as a percentage of GDP in the last decade.Which of the statements given above is/are correct?

a) 1 only

b) 2 only

GS 3: Science & Technology – Space science, astrophysics, space weather

Context:

Researchers from Indian Institute of Technology Kanpur have developed a new method to predict solar activity cycles, improving advance warnings of solar storms that can disrupt satellites, power grids, and communication systems.

Key PointsWhy predicting solar cycles is difficultThe Sun’s activity follows ~11-year cycles driven by internal magnetic fields.These magnetic fields originate deep inside the Sun, making direct observation difficult. Limitations of earlier modelsTraditional dynamo models relied on simplified assumptions about sunspots.They often treated sunspots as symmetrical and regular, unlike real observations. New approach by IIT-KanpurThe team simulated invisible magnetic fields inside the Sun using 30 years of surface data.Instead of theoretical shapes, they used real observational records of sunspots. Use of observational dataData sourced from space observatories like SOHO and Solar Dynamics Observatory.Helps link surface observations to internal solar magnetic activity. Key scientific insightThe Sun’s internal magnetic field behaves like a toroidal (doughnut-shaped) structure.This structure is the primary driver of sunspot formation and solar cycles. Improved prediction capabilityModel successfully reproduced 23 out of 24 solar cycles.Can predict cycle strength and peak amplitude up to three years in advance. Practical significanceBetter prediction of solar flares and coronal mass ejections.Enables early warnings to protect satellites, power grids, aviation, and communication networks. UPSC Prelims Practice QuestionConsider the following statements regarding solar cycles:Solar cycles are primarily driven by the Sun’s internal magnetic fields.Improved prediction of solar cycles can help reduce risks to satellites and power grids on Earth.Which of the statements given above is/are correct?a) 1 only

b) 2 onlyCorrect Answer: c) Both 1 and 2Explanation:

Statement 1 is correct because solar cycles arise from magnetic field dynamics inside the Sun.

Statement 2 is correct as accurate solar cycle prediction helps mitigate space weather-related disruptions. Source: The Hindu

GS 1: Geography – Climatology; Indian monsoon and ENSO phenomena Context:

The India Meteorological Department (IMD) has indicated that El Nino conditions may develop after July, with greater clarity expected only after April, raising concerns about the 2026 southwest monsoon. Key Points

Current ENSO status

ENSO-neutral conditions are likely to persist till July.There is a possibility of a transition towards El Nino thereafter.Probability outlookClimate models show over 50% chance of El Nino appearing after June.Probability may rise to around 70% during July–September. Why April is crucial

February–March forecasts are generally prone to errors.

April forecasts are considered more reliable for ENSO assessment. What is El NinoEl Nino refers to abnormal warming of the central and eastern equatorial Pacific Ocean.Defined when sea surface temperatures are at least 0.5°C above normal for five consecutive overlapping three-month periods. Impact on Indian monsoonHistorically, 6 out of 10 El Nino years have seen below-normal rainfall in India.

El Nino is often linked to weaker monsoon circulation and drought risk. Past occurrenceThe last global El Nino event occurred during 2023–24.That year witnessed below-normal rainfall in several parts of India. Seasonal importanceJuly and August are the most critical months for the summer monsoon.Any El Nino development during this phase can significantly affect rainfall distribution. Temperature outlookIMD forecast indicates hotter-than-normal conditions over most of India in February.Exceptions include parts of northwest and east-central India. India Meteorological DepartmentIndia Meteorological Department highlighted that El Nino forecasts become more accurate closer to the monsoon onset.The IMD continues to monitor Pacific Ocean temperatures and atmospheric indicators for refined projections.

GS 2: Polity & Governance – Internal security, federalism, President’s Rule, ethnic conflict

Context:

Thousands of people held a “Save Manipur” rally in Imphal to assert that the territorial and administrative integrity of Manipur should not be compromised amid ongoing ethnic tensions and demands for separate administrative arrangements.

Key PointsAbout the rally

The rally was held in Imphal, the capital of Manipur.Participants marched about 5 km from Tiddim Ground to Thau Ground. Organising body Organised by the Coordinating Committee on Manipur Integrity (COCOMI).COCOMI is an umbrella body of Meitei civil society organisations. Core demandsNo division of Manipur on territorial or administrative lines.No compromise on the State’s integrity.Resettlement of Internally Displaced Persons (IDPs) to their native places. Background to the protestThe rally follows prolonged ethnic violence since May 2023.Violence has mainly involved Imphal Valley-based Meiteis and hill-based Kuki-Zo groups. Kuki community demandThe Kuki community has been demanding a separate administrative mechanism.This demand has intensified concerns over territorial fragmentation. Humanitarian impactAt least 260 people killed.Thousands rendered homeless, leading to large-scale internal displacement. Inclusive participationProtesters included Meiteis, Manipuris, Muslims, and Naga communities.Emphasis on collective assertion of unity.Political and administrative statusThe State has been under President’s Rule since February.Security arrangements tightened across Imphal during the rally. President’s RulePresident’s Rule is imposed under Article 356 of the Constitution when a State government cannot function according to constitutional provisions.During this period, executive authority vests with the President, exercised through the Governor.

UPSC Prelims Practice Question

Consider the following statements:1.President’s Rule in a State is imposed under Article 356 of the Constitution of India.2.Internally Displaced Persons (IDPs) are people who cross international borders due to conflict or violence.Which of the statements given above is/are correct?a) 1 only

b) 2 only